Idle Cash Optimization is one of the most crucial daily operations in the banking industry. When conducted using modern statistical methods and machine learning algorithms, there is potential for huge savings through decreasing idle cash on closing balances and cost of cash-in-transit (CIT) operations.

Idle cash is the cash that has not been invested in an interest-bearing account or in the financial markets. For cash flow management, it corresponds to cash staying idle in ATM and Branch vaults at the end of the day which shall not be needed until the next replenishment cycle. In other words, it is money that is staying “idle” in ATMs and Branches. Since the cash is not returned to main vault, it is imposing interest cost which could otherwise be saved by idle cash optimization.

There are various options that banks may follow in order to manage their idle cash in ATMs and Branches; however the most feasible way is using an optimization software that would generate timely transaction forecasts and cost-optimal cash transfer orders (CIT Scheduling) for each ATM and Branch within the network. Idle Cash Optimization hence becomes a Machine Learning and Mathematical Optimization problem.

Based on current deployments, Arute Cash+, which is a machine learning and operations research based cash prediction and replenishment optimization software, is capable of decreasing idle cash levels by %20-%40 on average for its users. By continuously analyzing ATM profiles via their variable data such as past demands, current trends, seasonality, holidays and up-to-date events, Cash+ successfully provides ATM replenishment schedules and order recommendations for each ATM achieving a weekly minimized cost target. Having one of the highest predictive accuracies in the industry, Cash+ is also available for a rapid on-site deployment.

Simulation to foresee the benefit of idle cash optimization

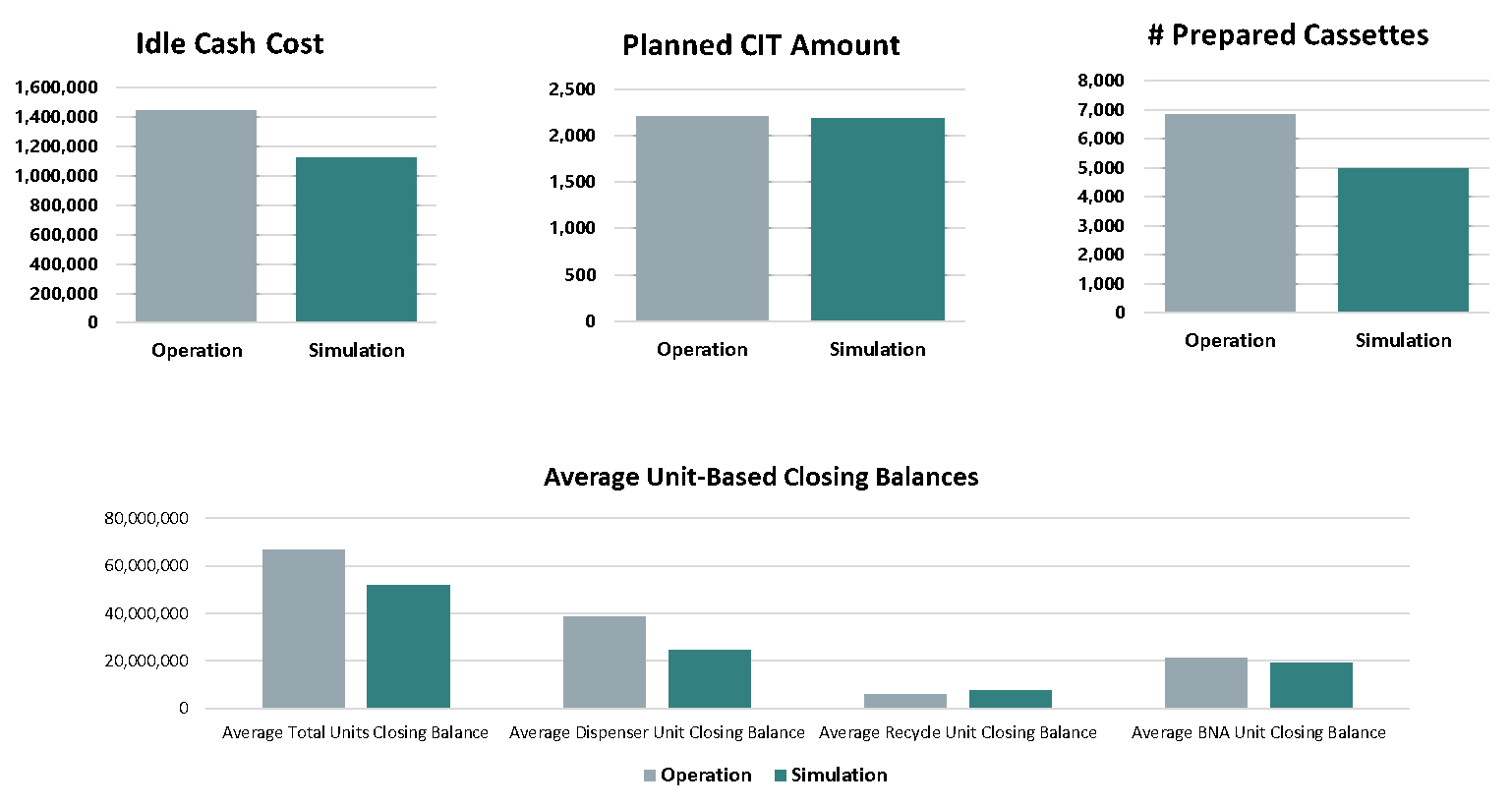

Cash+ Simulation module is designed to validate, optimize, foresee the replenishment cycles using different parameter sets. To observe and verify the potential in idle cash optimization capability of Cash+, a simulation run can be carried out which compares the real-life operational metrics with that of Cash+ deployed metrics. For this simulation, historic transaction data is required so that new predictions and replenishment plans can be produced and compared by the actual operation data.

Below sample comparison charts for different KPIs can be observed for a simulation run of Cash+:

Malls continued to have almost one third of withdrawals as their shops were still not open on May. They are opened in June, so the results of June would be more interesting for this type of ATMs. The transactions are perhaps due to some open shops such as pharmacies and markets in the Malls that drive some human traffic and some administrative personnel.

Leave a Reply